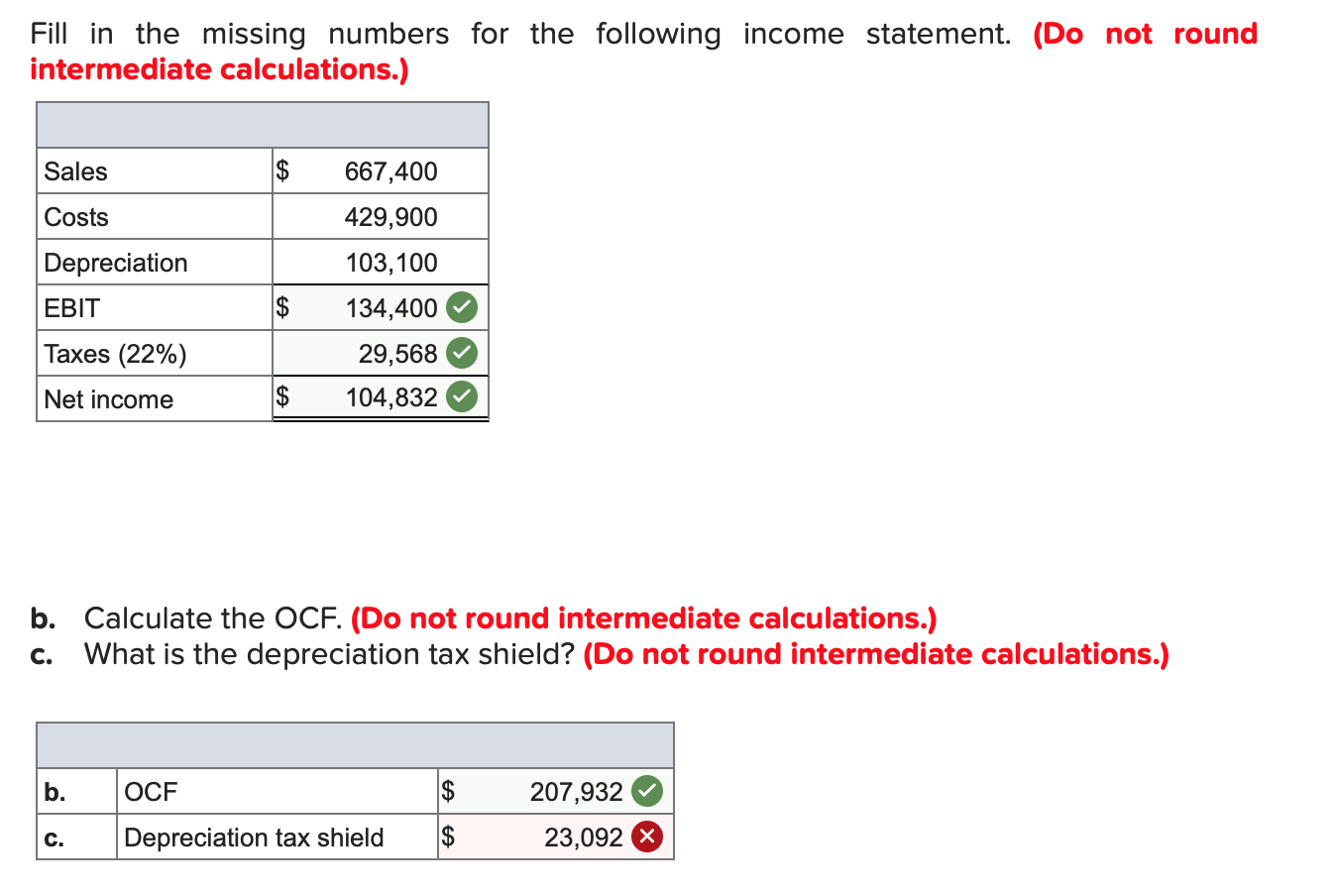

In order to qualify, the taxpayer must use itemized deductions on their tax return. The deductible amount may be as high as 60% of the taxpayer’s adjusted gross income, depending on the specific circumstances. In the above example, we see two cases of the same business, one with depreciation and another without it.

Sales & Investments Calculators

These deductions reduce a taxpayer’s taxable income for a given year or defer income taxes into future years. Tax shields lower the overall amount of taxes owed by an individual taxpayer or a business. Anyone planning to use the depreciation tax shield should consider the use of accelerated depreciation. This approach allows the taxpayer to recognize a larger amount of depreciation as taxable expense during the first few years of the life of a fixed asset, and less depreciation later in its life.

Examples of non-deductible business expenses

The project would have a life of 5 years at the end of which the plant and machinery could fetch a value of $30,00,000. Suppose we are looking at a company under two different scenarios, where the only difference is the depreciation expense. Based on the information, do the calculation of the tax shield enjoyed by the company.

Tax Shield Formula

The concept of depreciation reflects the diminishing value of assets over time. The Depreciation Tax Shield accounts for this reduction by allowing businesses to deduct depreciation from taxable income, thereby reducing the overall tax burden. Have you ever wondered how depreciation affects how much taxes a business pays? Let’s explore how this important concept can impact a company’s financial planning and tax liability. This small business tool is used to find the tax rate by using interest expenses and depreciation expenses.

Everything You Need To Master Financial Modeling

The Depreciation Tax Shield Calculator assists in determining the financial benefit derived from the depreciation of assets, which can be deducted from taxable income. This tool is especially useful for businesses looking to maximize tax efficiency by leveraging asset depreciation. It’s advisable to calculate your tax shield annually, as part of your tax preparation process. However, if your business experiences significant changes in expenses or income, recalculating more frequently can help you adjust your financial planning accordingly. Non-deductible expenses include fines, lobbying expenses, political contributions, and any costs not directly related to business operations.

Examples of deductible business expenses

Therefore, the 1st option is better since it offers a lower cost of acquisition. The Depreciation Tax Benefit reflects the money saved on Income Taxes due to Depreciation Expense. The Interest Payments are typically tax-deductible, which lowers the Company’s tax bill. As you can see, the Taxes paid in the early years are far lower with the Accelerated Depreciation approach (vs. Straight-Line). As an alternative to the Straight-Line approach, we can use an ‘Accelerated Depreciation’ method like the Sum of Year’s Digits (‘SYD’). In the section below, we cover two of the most common methods and their Cash Flow and Valuation impacts.

Beyond Depreciation Expense, any tax-deductible expense creates a tax shield. The booked Depreciation Tax shield is under the Straight Line method as per the company act. The net benefit of accelerated depreciation when we compare to the straight-line method is illustrated in the table below. For more detailed information, consider consulting a tax professional or financial advisor. Additionally, governmental tax websites and reputable financial education resources offer guidance on tax planning and strategies.

Please be aware, the privacy policy may differ on the third-party website. Adtalem Global Education is not responsible for the security, contents and accuracy of any information provided on the third-party website. Note that the website may still be a third-party website even the format is net operating profit after tax nopat similar to the Becker.com website. Our mission is to provide useful online tools to evaluate investment and compare different saving strategies. To wrap this up, we hope you now have a much better understanding of the Depreciation Tax Shield Calculation as well as the underlying concept.

When filing your taxes, ensure you are taking these deductions so that you can save money when tax season arrives. Tax shields allow for taxpayers to make deductions to their taxable income, which reduces their taxable income. The lower the taxable income, the lower the amount of taxes owed to the government, hence, tax savings for the taxpayer. The term “tax shield” references a particular deduction’s ability to shield portions of the taxpayer’s income from taxation.

The tax shield is an incentive for investing because it allows one to receive tax benefits before an investment generates profits. On the income statement, depreciation reduces a company’s earning before taxes (EBT) and the total taxes owed for book purposes. However, the straight-line depreciation method, the depreciation shield is lower.

- Our mission is to provide useful online tools to evaluate investment and compare different saving strategies.

- The net benefit of accelerated depreciation when we compare to the straight-line method is illustrated in the table below.

- It is the method companies use to allocate the cost of an asset, which may be machinery, building, etc., throughout its useful life.

- That interest is tax deductible, which is offset against the person’s taxable income.

- Businesses can use depreciation to spread out their tax deductions over time and manage their money better.

Here, we explain the concept along with its formula, how to calculate it, examples, and benefits. You may also look into the related articles below for a better understanding. Finally, we conclude on account of the above-stated cases that a tax shield can be utilized as a valuable option for effectively evaluating cash flow, financing, etc., activities. By comparing the above two options calculated, we concluded that the present value in the case of buying by taking a tax shield is lower than the lease option. Another option is to acquire the asset on a lease rental of $ 25,000 per annum payable at the end of each year for 10 years. The ability to use a home mortgage as a tax shield is a major benefit for many middle-class people whose homes are major components of their net worth.